As with any incoming administration, changes in our government’s policies can affect your small business. The Trump administration is no different. While small businesses are more affected by state and local law changes, shifts in our federal laws can also make an impact.

Here’s the good and the bad that you can expect from our new president:

Simplification of the tax code

Our tax code currently has seven brackets with corporations paying up to 35% in taxes. President Trump has vowed to simplify the whole mess and reduce corporate tax to 15% for most business structures.

The good: This simplification could mean less taxes for a lot of small businesses, plus less hassle at tax time.

The bad: Many have said that a tax cut of this size could increase our national deficit, putting us further in debt.

Recommendation: Based on the current speed this administration is moving, changes to the tax code will happen quickly. It’s a good idea to work with a trusted advisor who can quickly tell you how this will affect your business, and how to make the most of any changes.

Less regulation

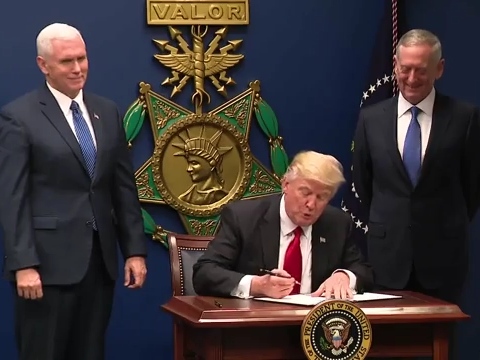

According to the National Federation of Independent Business, 45% of business owners count regulations as one of their most serious problems. Trump has signed an executive order to effectively cut any new regulations. He’s also promised to roll back some of the current regulation to make it easier for businesses to operate.

The good: For all those businesses suffering from too many regulations, this could be the exact solution they’re after. It’s reported that the average small business owner spends $12,000 a year dealing with regulations, that’s quite a hefty savings.

The bad: Many of the regulations Trump is focusing on are environmental, and come from the EPA and things like the Paris agreement (which limits the amount of greenhouse gases worldwide). This could make a difference for manufacturing businesses, however not a lot of other small businesses currently run afoul of the EPA.

Recommendation: If you’re saving a significant amount on regulations this year, it’s key that you know how to put that money to work in your business. You’ll also want to keep an eye on the regulations that directly affect you. If they change you’ll want to take advantage immediately.

Banks and lending

Trump has repeatedly criticized the Dodd-Frank Act saying it keeps bankers from being able to loan money to businesses. A change or removal to this act could be in our future.

The good: Getting a small business loan could be easier than ever as banks would be free to loan money to less established businesses.

The bad: The Dodd-Frank Act was put into place after the banking crisis in 2008. Removing some of that regulation could lead to a rise in predatory lending practices.

Recommendation: When applying for a bank loan, make sure you understand your loan conditions. Be clear on what can cause your interest rate to rise, and what you will do if that happens. Think about the worst case scenario, like if your business fails, do the terms of this loan still make sense? Will you be able to pay it back? Once you understand the risks you can sign on the dotted line.

Health care

The Affordable Care Act has been a target of Trump since his campaign days, and his executive order affirmed that he plans on reducing or removing it. Employers with 50 or more full time employees are currently required by law to offer health insurance to their employees. A change to the ACA could impact a large number of businesses.

The good: The changes to the ACA could reduce the cost of health insurance for your employees. If you’ve been hesitant to expand due to these costs, this could be your year to take the leap.

The bad: Trump has been unclear on what will replace the ACA. He’s said he wants to leave it up to the states, but the exact plan has yet to be decided.

Recommendation: This is a great time to contact your state officials and weigh in on how health insurance costs affect your business. Having control given to the states could make it easier for your voice to be heard as plans are put in place.

To make the most of all these changes, you’re not only going to need to know when they happen and how they affect you, you’re also going to need to act quickly. Get in touch with us today for a free consultation to get prepared to take advantage of any upcoming changes that could affect your business.

Related Articles

Parties and other events are a great way to engage and reward employees and customers, and it’s also an opportunity to find tax deductions. But the tax rules for such events are strict and require careful planning and navigation to ensure you can claim your deductions with confidence.

Read on how to deduct the cost of a business party while also being conscious of potential tax deductions.

The various taxes that small businesses have to pay out each year are significant, so it’s important to be aware of every opportunity the tax man gives you to reduce your bill. So be sure to consider whether any or all of the items in this checklist apply to your business and discuss them with your bookkeeper and accountant to ensure you are documenting and claiming every deduction available to you.

With tax season approaching, you will want to take advantage of any and all deductions legally available to you. And if you aren’t satisfied with this year’s write-offs, you’ll want to start looking ahead next year to ensure you are aware of and actively documenting everything you could be deducting.

Financial fraud is the number one consumer complaint in the United States, and it can have devastating consequences for victims.

But by being proactive and following some simple steps, you can make it much more difficult for criminals to steal your money or your identity. Read about implementing some measures to protect you!

Now is the time to start thinking about the coming year, and what changes you could make to reduce your bill next time the taxman comes around.

Take a look at several ways businesses are reducing their tax burden.

Good financial reporting can help a business track what is really important for profitability and guide good decision-making for the future. Many small businesses struggle to really take full advantage of their financial reporting.

Take a look at five tips that could make the difference in whether your financial reports tick boxes or truly help drive growth.

Accounting and invoicing for general contractors have always been a paperwork-intensive process, tracking various construction-specific tasks like estimates, sourcing subcontractors, handling change orders, and partial-completion invoicing.

Let’s take a closer look at what makes construction invoicing different – and difficult – and consider a few highly-regarded apps that are worth considering, not only for invoicing but potentially for the entire end-to-end construction process, from submitting bids to paying contractors to customer relations.

Filing as an S Corp eliminates the self-employment tax on all income that many small businesses pay, while at the same time keeping some income out of reach of things like Medicare and Social Security taxes. It offers you the opportunity to take part of your income as a W-2 salary, with the associated federal program taxes, and the rest of it as distributions that are not subject to those taxes.

As with most “great deals,” though, there are potential pitfalls. It’s important to take the process seriously and abide by the rules in order to reap the benefits while avoiding some very serious penalties.

Let’s take a look at the benefits and potential pitfalls of filing as an S Corp, and how you can pay yourself in a way that maximizes your tax benefits while minimizing your compliance risks.

Filing as an S Corp eliminates the self-employment tax on all income that many small businesses pay, while at the same time keeping some income out of reach of things like Medicare and Social Security taxes. It offers you the opportunity to take part of your income as a W-2 salary, with the associated federal program taxes, and the rest of it as distributions that are not subject to those taxes.

As with most “great deals,” though, there are potential pitfalls. It’s important to take the process seriously and abide by the rules in order to reap the benefits while avoiding some very serious penalties.

Let’s take a look at the benefits and potential pitfalls of filing as an S Corp, and how you can pay yourself in a way that maximizes your tax benefits while minimizing your compliance risks.